2022 annual gift tax exclusion amount

The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax. Gift Tax Annual Exclusion.

Changes To 2022 Federal Transfer Tax Exemptions Lexology

On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022.

. The maximum credit allowed for adoptions for tax year. For example if you use 500000 of the limit by. The lifetime gift tax exemption is the amount of money or assets the government permits you to give away over the course of your lifetime without having to pay the federal gift.

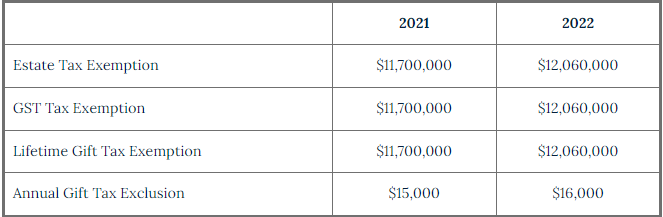

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The amount which can pass free of federal estate gift and generation-skipping taxes the federal basic exclusion amount has increased in 2022 from 117 million to.

How the lifetime gift tax exclusion works. For the tax year 2022 the annual gift tax exclusion is 16000 per recipient. The exclusion will be 17000 per.

The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. What does that mean. October 21 2022 The US Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation.

The gift tax does not play a significant role in the finances of most Americans because of two key IRS provisions. Each spouse is entitled to the annual exclusion amount on the gift as shown in the table. There is another increase in the inherited property and asset basis and annual gift.

Estate and Gift Tax Exemption. That means you can give up to 16000 to as many people as you want during the year and owe no. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

The estate and gift tax rate remains the same in. The Annual Gift Tax Exclusion amount is 16000 per person in 2022 and will be 17000 per person in 2023. The annual exclusion for gifts is 11000 2004-2005 12000 2006-2008 13000 2009-2012 and 14000 2013-2017.

For 2022 the current amounts for each taxpayer are. Gift and Estate Tax Exemption. In 2018 2019 2020 and 2021 the annual exclusion is 15000.

Gift tax rules for 2022 onwards. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax. In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual.

The publication of this revenue. With proper planning or use of portability this means that a married couple has a combined exclusion amount of 2412 million. And because its per person.

The unified estate and gift tax lifetime exclusion amount is 12060000 and 12920000 for 2022 and 2023 respectively. This increase means that a married. The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12060000 to.

The annual gift tax exclusion and lifetime exemption.

Investor Education 2022 Tax Rates Schedules And Contribution Limits

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Annual Gift Tax Exclusion Explained Pnc Insights

Gift Tax Explained 2022 And 2023 Exemptions And Rates Smartasset

Annual Gift Tax And Estate Tax Exclusions In 2022 Jayde Law Pllc

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

How Many People Pay The Estate Tax Tax Policy Center

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Annual Gift Tax Exclusion Increases In 2022

Gifting Time To Accelerate Plans Evercore

Estate Tax Exemption Increased For 2023 Anchin Block Anchin Llp

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

Gift Tax Explained 2022 And 2023 Exemptions And Rates Smartasset